With all the hype surrounding Google Ads’ Performance Max (PMax) campaign we decided to take a deeper look into exactly what this black box is really doing with your hotel marketing dollars. The clever three&six team have analyzed keyword data from these notoriously opaque campaigns, and uncovered the truth about PMax for hotels.

Pinpointing PMax?

Google describes PMax as a new goal-based campaign type that allows performance advertisers to access all of their Google Ads inventory from a single campaign. It’s designed to complement your keyword-based Search campaigns to help you find more converting customers across all of Google’s channels like:

- YouTube

- Display

- Search

- Discover

- Gmail

- Maps

Originally launched in 2021, PMax has been around for a while and uses AI and machine learning to allocate your budget where mere human advertisers fear to tread (or so we’re told).

Ads are created automatically from user-generated headlines and content allowing Google to use them in any order they feel is optimal for performance. Google even automatically creates assets and marketing language that it feels may be a better fit than your own carefully crafted branding message.

We’re also told that Google analyzes your hotel website and gains insights from the content you display about your property.

Sounds like a marketer’s dream, right?

PMax Problems

The biggest issue all marketers have faced with PMax is the lack of detail in the Google Ads platform. Due to the way Pmax works, there is no keyword data … like, none at all. You have to go hunting for this data and even then it is opaque and not as presentable as other campaign keyword data is. This got us thinking (and worrying) – why is there such a lack of transparency?

It’s also not just keyword data, but also channel data. There’s a distinct lack of information that shows where your marketing spend is going. How much is going to Youtube vs Gmail is virtually impossible to find.

So, this just made us more determined.

PMax Policy Puzzles

It’s no secret within digital marketing circles that PMax will target your hotel brand name search terms unless you instruct Google not to do this. However, we had suspicions that PMax was not adhering to their own policies.

Google’s help file say that:

- Performance Max complements existing search campaigns and respects your keyword targeting.

- If the user’s query is identical to an eligible search keyword of any match type in your account, the search campaign will be prioritized over Performance Max.

- If the query isn’t identical to an eligible search keyword, the campaign or ad with the highest Ad Rank, which considers creative relevance and performance, will be selected.

On the face of it, everything seems fine, but Google goes on to list a host of circumstances where they will overrule these policies. Things like limited budget and targeting are reasons Google can show PMax over your standard campaigns.

This led us to question exactly how often this was happening.

Peeking into PMax

As mentioned, most PMax data is not displayed in the traditional Google Ads platform and the data that is displayed is more of an overview than anything meaningful or actionable. But there are treasures to be found.

For all our client PMax search campaigns we uncovered various data points. We concentrated on the following:

- Impressions

- Clicks

- Bookings

- Booking Value

We also worked on channel split based on spend to see where else Google was pushing money outside of search terms.

The results were both predictable and surprising.

PMax’s Performance Potholes

We have a broad mix of campaigns for our hotel clients that are excluding brand terms and some that are not. We felt this would be a useful test to see how much PMax was targeting brand terms.

We found that 95.7% of all accounts had some level of brand keyword targeting, which was our original theory. However, campaigns that do not exclude brand terms are almost exclusively bidding on brand terms.

Our research found that 96.5% of all keywords being clicked were brand, despite having separate brand campaigns already targeting these keywords.

In some cases (typically where budgets were lower), we found that 100% of all keywords targeted by PMax were brand terms.

It is not entirely surprising that PMax was cannibalizing branded search terms, but the extent to which it is doing so was a shock.

PMax’s Precision Predicament

Theoretically, we should expect the exact opposite when we tell PMax not to bid on brand terms. The platform does not support directly adding keywords you wish to exclude from your PMax campaigns, but Google allows a website URL to be added in what it calls a Brand List. This allows Google to scan the website and identify what the brand is and stands for. When adding a hotel brand list, we expected to see brand clicks to drop to zero, but they didn’t.

Of those that actively applied Brand Lists, 93.75% had some level of brand keyword clicks.

The average amount of total clicks from brand terms was 22.87%, which is considerably lower than campaigns without brand list exclusions, but still not the close to 0% we’d expect.

Problematic PMax Profit

Looking at the volume of traffic PMax is generating for brand terms led us to wonder about revenue performance – let’s be honest, this is the biggest reason why we advertise in the first place.

When PMax is allowed to work without any brand restrictions, we saw 98.9% of all generated revenue coming from brand keyword terms.

Even with Brand Lists added and the assumption branded keywords would be avoided, 36.9% of all revenue came from branded terms.

Pondering PMax’s Picks

When PMax has overlooked brand terms and targeted keywords that would be considered more upper funnel, we start to see the extent of the AI capability. In the majority of times it is targeting fairly reasonable keywords, we have even seen some converting at strong ROAS levels (up to 8.25). However, some keyword targeting decisions clearly highlight that PMax is a tool for the masses and is not designed exclusively for hotels (despite the fancy marketing).

We’ve found some clear evidence that whilst PMax AI is clearly very advanced, it is still making some questionable decisions with your marketing dollars. The lack of transparency is hiding these decisions and it is all being brushed under the carpet because brand terms will always generate bookings and positive ROAS.

PMax in Practice

Some common themes we’ve found highlighting questionable keyword targeting include:

Restaurants – if a property has an onsite restaurant we’ve found significant keyword targeting for the restaurant brand name, but also top of funnel targeting. One particular PMax campaign identified an onsite seafood restaurant and targeted “fish restaurants”. In fact, most PMax campaigns targeted “[Area] restaurants” or “[Area] fancy restaurants” depending on the perceived quality of the restaurant that Google’s AI felt it deserved. We also saw keyword wastage targeting famous/well-known offsite restaurants in the immediate area.

Local attractions – we saw repeated evidence of keywords targeting things of interest nearby. We thought this was great and made a lot of sense in some cases, but investigating further we realized this lacked detail. The keyword bidding targeted the attraction, but made no qualification for the audience looking for a hotel nearby. For example, one hotel targeted the Kennedy Center and spent a significant portion of the non-brand budget on this, but none of keywords clicked included “hotel” or “hotel near” – it was generic bidding on kennedy center keywords and some targeting “kennedy center box seat”.

Compset targeting – we saw significant compset targeting, especially with hotel names that were similar to the client property. If the geographical proximity of the competitor hotel was close by, we found the level of spend went up considerably. In almost all occasions we found the ROAS was negative and this was not a tactic that the algorithm made work.

Residences – For any short term properties, PMax had real difficulty understanding the difference between short term hotel properties and generic real estate properties. There were huge wastages in clicks targeting “affordable housing”, “craigslist rentals”, and generic “apartments” terms.

Experiential Properties – for one particular beach resort we encountered 99.5% non-brand bidding (with Brand Lists applied). This seemed to go against the common trend and further investigation found that the website crawl almost gave the algorithm too much to think about. Because this property offered local experience packages (swimming and diving with sea life plus hiking trips) as well as traditional room bookings, we saw keyword clicks covering a huge array of topics. Keywords covering generic “hiking” and “adventures” or looking for the “best beaches in X for swimming” were highly targeted.

Random – there were a lot of keywords that left us very confused. It would seem that the website scan would collect and seize upon the most random facts. For example, we saw “coffee near me” because it is available in the room. Similarly keywords targeted “tennis near me” because a venue mentioned in the nearby attractions offered tennis courts. Similarly, a lot of click wastage came from “job” related search terms.

However, we did see some positive keyword targeting trends:

Hotel terms – the vast majority of non-brand bookings came from generic terms you would expect. “best boutique hotels in [area]”, “best resort in [area]”, “top hotels in [area]” or “hotels in [area]” all did well.

Amenities or Unique amenities – we found the algorithm worked well at finding unique keywords that would not normally be found by human targeting, especially when relating to amenities. Hotels offering a “Spa” not only saw strong revenue performance, we also saw less brand keyword bidding with Brand Lists were applied.

PMax’s Phony Protection

Our testing has seen us try all kinds of tactics and targeting. In one outlying case we decided to leave the targeting as broad as possible (as advised by Google’s own documentation on PMax). We set the geographical targeting to Worldwide for a North American-based hotel and the results were quite troubling.

Given the alleged advancement in AI technology behind PMax, we were surprised to see that the algorithm decided to heavily target India and 53.9% of all clicks targeted this area. In fact, the whole of the US accounted for just 1.18% of all clicks. You don’t need an algorithm to understand that this is disproportionate geo-targeting and not likely to lead to any worthwhile return on ad spend.

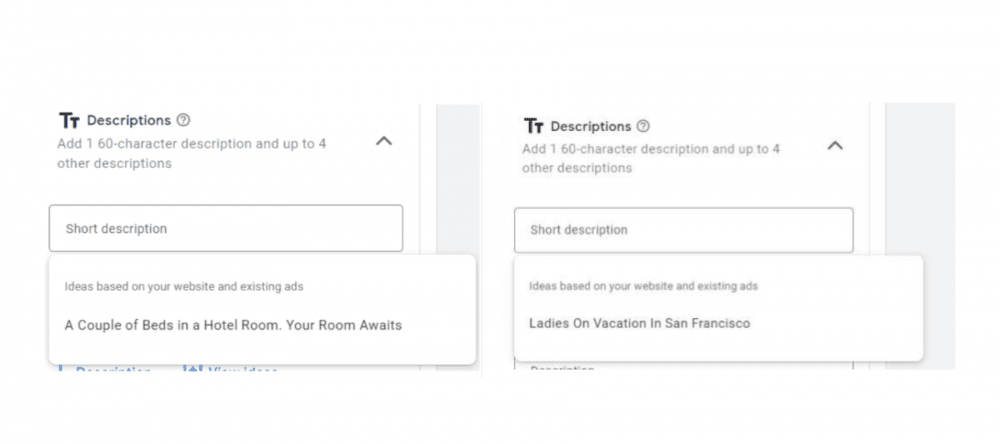

PMax’s Poor Prose

As an interesting side project, the three&six team has been assessing the quality of the automatically generated ads that PMax offers. This feature lets Google craft headlines and descriptions from your landing pages to display in your ads, aiming to enhance performance.

In a lot of cases the suggestions are sensible, if a little bland. However, we have seen some interesting suggestions.

Whilst factually accurate, “a couple of beds in a hotel room” is going to fall foul of most property brand guidelines!

Pursuing Peak PMax Performance

Despite our initial concerns, we can see that PMax can be controlled. Google has recently introduced a direct way to request negative keywords to be added to the account. This should allow the reduction in irrelevant keywords which will push the non-brand ROAS higher – far higher than most manually managed campaigns (assuming a fair and reasonable attribution model).

This is still being tested, but early results have shown that the three&six team can enhance performance significantly in PMax campaigns. Our optimization techniques have shown to cut keyword click wastage, saving budget and improving ROAS.

Conclusion

It’s evident that there are significant concerns and issues with PMax that Google and other hotel agencies may not be fully disclosing to their clients or just don’t know. Google’s lack of transparency in keyword and channel data, coupled with their AI’s questionable decision-making in targeting irrelevant or brand-cannibalizing keywords, raises red flags for hotel marketers. Despite Google’s claims that PMax respects keyword targeting and complements existing search campaigns, the data suggests otherwise, with a high percentage of brand keyword targeting even when explicitly excluded.

While PMax has shown some positive results in targeting relevant hotel-related terms and unique amenities, the overall performance of these campaigns has been erratic. The instances of wasted ad spend on irrelevant keywords, geographical targeting, and brand cannibalization underscore the need for marketers to be cautious and vigilant when utilizing PMax for their hotel advertising. PMax is not a set and forget tactic.

Want to know how your PMax campaigns are really performing? Get in touch with three&six team for free review.